Understanding the Significance of an Income Tax Return: Exactly How It Influences Your Economic Future

Understanding the importance of a Tax return prolongs past simple conformity; it acts as a crucial device in forming your economic trajectory. A thorough tax return can influence crucial decisions, such as car loan eligibility and prospective cost savings through credit scores and reductions. Additionally, it uses insights that can tactically inform your investment selections. Nonetheless, lots of individuals ignore the implications of their tax filings, usually forgeting the wealth-building possibilities they provide. This raises vital inquiries regarding the broader influence of income tax return on long-term economic stability and preparation. What might you be missing out on?

Introduction of Tax Obligation Returns

Income tax return are essential files that people and businesses submit with tax authorities to report earnings, expenditures, and other monetary details for a details tax year. These comprehensive kinds offer multiple functions, consisting of establishing tax obligation liabilities, declaring reductions, and reviewing eligibility for various tax credits. The primary elements of an income tax return commonly consist of income from all sources, adjustments to earnings, and an in-depth failure of reductions and credit ratings that can decrease general taxable earnings.

For individuals, typical types include the IRS Form 1040 in the United States, which describes salaries, rate of interest, returns, and other forms of income. Businesses, on the other hand, may utilize the internal revenue service Kind 1120 or 1065, relying on their framework, to report business earnings and costs.

Filing tax returns properly and prompt is crucial, as it not only guarantees compliance with tax obligation regulations however also impacts future financial preparation. A well-prepared tax obligation return can supply insights into financial health, emphasize locations for potential savings, and promote enlightened decision-making for both businesses and people. The complexities involved demand a detailed understanding of the tax code, making professional advice commonly useful.

Impact on Loan Qualification

Timely and exact submission of tax obligation returns plays a crucial role in establishing an individual's or service's qualification for finances. Lenders usually call for current income tax return as part of their evaluation procedure, as they offer a detailed summary of income, economic stability, and general financial wellness. This documentation assists loan providers determine the borrower's capability to pay back the funding.

For people, consistent income reported on tax returns can improve credit reliability, leading to much more beneficial finance terms. Lenders typically search for a steady earnings background, as varying incomes can elevate problems concerning settlement ability. Similarly, for businesses, income tax return work as a significant indicator of success and capital, which are important aspects in safeguarding organization financings.

Furthermore, discrepancies or errors in tax obligation returns may raise warnings for loan providers, potentially resulting in lending rejection. Therefore, preserving accurate documents and filing returns on time is essential for businesses and people aiming to improve their financing qualification. In final thought, a well-prepared income tax return is not just a legal need however also a critical tool in leveraging monetary opportunities, making it basic for anybody considering a financing.

Tax Credit Scores and Reductions

Comprehending the subtleties of tax credit scores and deductions is vital for maximizing economic results. Tax obligation credit ratings straight lower the amount of tax owed, while reductions reduced gross income. This distinction is substantial; as an example, a $1,000 tax obligation credit history decreases your tax expense by $1,000, whereas a $1,000 reduction decreases your taxed income by that quantity, which causes a smaller sized tax obligation reduction depending on your tax bracket.

Deductions, on the other hand, can be made a list of or taken as a typical reduction. Itemizing allows taxpayers to checklist eligible costs such as home loan interest and clinical expenses, whereas the basic reduction gives a set reduction amount based on declaring condition.

Planning for Future Investments

Effective planning for future investments is important for constructing wide range and accomplishing monetary goals. A well-structured investment method can help people profit from prospective growth chances while likewise alleviating risks related to market changes. Comprehending your income tax return is a vital part of this planning procedure, as it provides insight right into your monetary health and wellness and tax obligation responsibilities.

In addition, understanding just how investments might affect your tax obligation scenario allows you to pick investment lorries that straighten with your general financial strategy. Focusing on tax-efficient financial investments, such as lasting funding gains or municipal bonds, can boost your after-tax returns.

Usual Income Tax Return Myths

Lots of people hold misconceptions about tax obligation returns that can lead to complication and pricey blunders. One common myth is that filing a Tax return is just essential for those with a substantial revenue. In truth, also individuals with lower earnings might be needed to submit, specifically if they receive certain credit reports or have self-employment revenue.

An additional common myth is the belief that receiving a reimbursement indicates no taxes are owed. While reimbursements show overpayment, they do not discharge one from responsibility if tax obligations are due - Online tax return. In addition, some believe that tax returns are only important throughout tax season; however, they play an important role in economic planning throughout the year, impacting credit rating and finance eligibility

Many likewise right here think that if they can not pay their tax obligation bill, they need to avoid declaring entirely. This can bring about charges and interest, worsening the problem. Lastly, some assume that tax prep work software application warranties accuracy. While practical, it is very important for taxpayers to recognize their special tax circumstance and testimonial entrances to validate conformity.

Eliminating these misconceptions is crucial for effective monetary administration and staying clear of unneeded complications.

Conclusion

To sum up, income tax return function as a basic element of financial management, influencing finance qualification, revealing earned income credit possible savings through reductions and credits, and informing strategic investment choices. Neglecting the importance of accurate tax return declaring can cause missed out on economic chances and impede efficient monetary planning. Consequently, an all-encompassing understanding of tax obligation returns is essential for promoting long-term financial security and maximizing wealth-building strategies. Prioritizing tax obligation return understanding can significantly enhance overall economic health and wellness and future potential customers.

Tax obligation returns are important records that services and individuals file with tax obligation authorities to report earnings, expenditures, and other economic information for a certain tax obligation year.Submitting tax obligation returns precisely and timely is essential, as it not just ensures compliance with tax legislations yet also influences future financial planning. Nonrefundable credits can only minimize your tax liability to absolutely no, while refundable debts may result in a Tax reimbursement surpassing your tax pop over to this web-site owed. Common tax obligation credits include the Earned Earnings Tax Obligation Credit Scores and the Kid Tax Debt, both intended at supporting people and households.

In addition, some believe that tax returns are only essential during tax season; nonetheless, they play an important duty in financial preparation throughout the year, impacting debt scores and finance qualification.

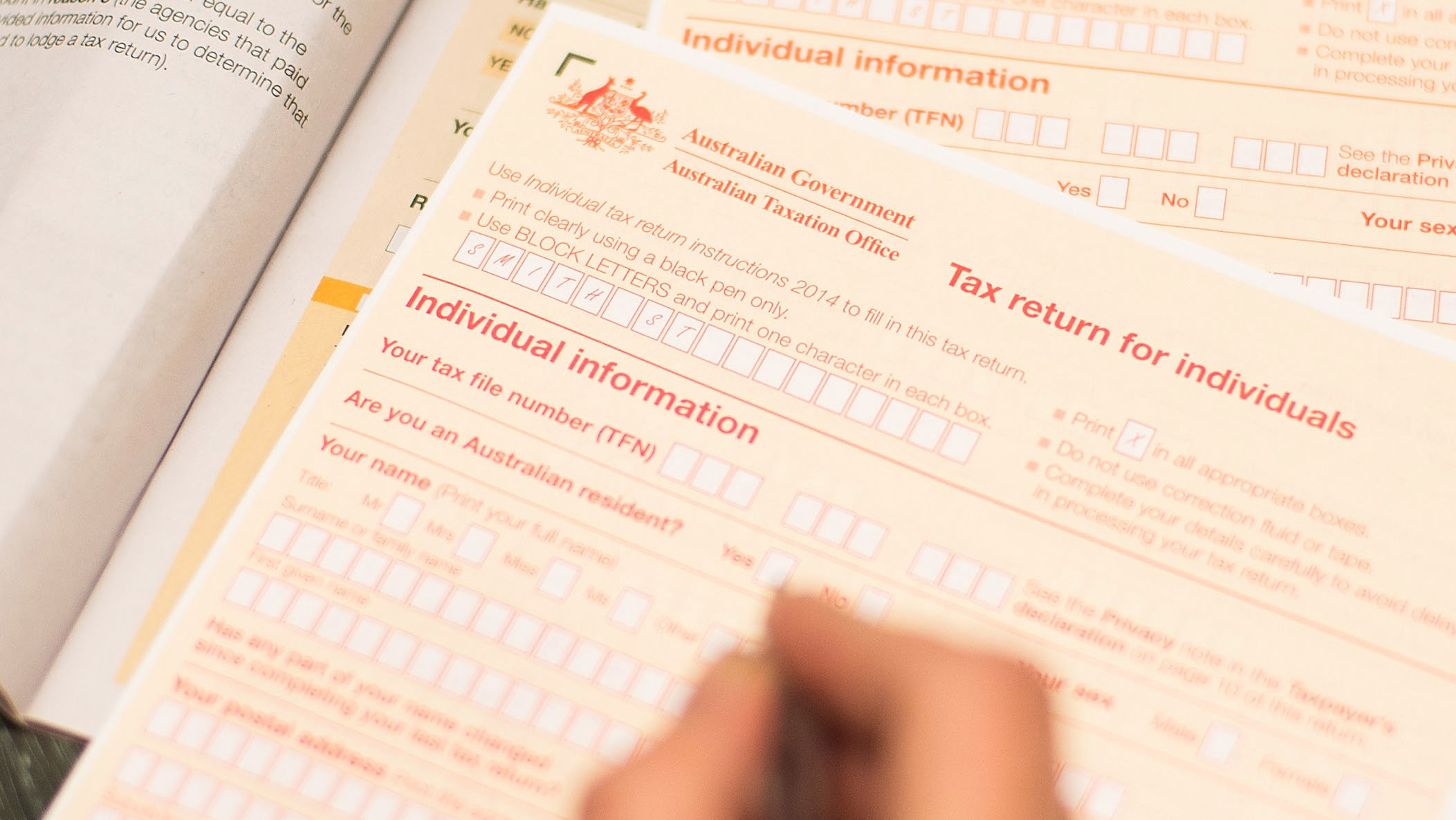

Comments on “How to Complete Your Online Tax Return in Australia Quickly and Accurately”